Earlier this month the Japanese agency holding company Dentsu announced quarterly financial results. For the nine-months ending December 31, 2012 revenues were up 4.5% and net income was up 48.1% year-over-year. Impressive? Certainly, but not inconsistent with other players in the ad sector; WPP achieved a 43.3% increase in net income on a 7.4% revenue gain and Omnicom Group reported a percentage net income increase which was twice that of its revenue growth.

Earlier this month the Japanese agency holding company Dentsu announced quarterly financial results. For the nine-months ending December 31, 2012 revenues were up 4.5% and net income was up 48.1% year-over-year. Impressive? Certainly, but not inconsistent with other players in the ad sector; WPP achieved a 43.3% increase in net income on a 7.4% revenue gain and Omnicom Group reported a percentage net income increase which was twice that of its revenue growth.

A healthy advertising sector represents good news for clients and agencies alike. Growing, profitable advertising agencies are able to invest in; infrastructure, personnel and research which ultimately allows them to better serve their clients.

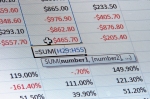

There are two interesting observations with regard to the aforementioned agency financial reporting; 1) the recent results fit a pattern of extraordinary net income growth for the category, relative to revenues. 2) In a professional services business, the ability to generate net income growth of 2X to 10X that of revenue can only be achieved through a combination of significant expense reductions and or dramatic increases in direct margin.

Let’s be clear. Like most other professional service providers whether in the financial, legal or consulting sectors, payroll makes up a disproportionately high percentage of an advertising agency’s expense base. The publicly traded agency holding companies break out salary expense within their financial reports, allowing for a review of this cost center. In a 2010 review of agency expense structures, Adweek reported that for the top five agency holding companies, expenses represented between 83% and 94% of revenues. Salary expenses ranged between 59% and 72% of revenues. The difference between the two is largely made up of real-estate and overhead costs.

Thus it is unlikely that agencies are relying on expense reduction as the primary source of net income accretion. This would have a dramatic, negative impact on the caliber of work, service levels and ultimately, client retention and would be unsustainable over any prolonged period of time. Therefore margin growth would appear to be the primary contributor to the extraordinary net income gains. But how you ask? After all, industry compensation surveys consistently report that the average agency profit level identified within client/ agency agreements is 15%.

Unfortunately the answer is clear, while not altogether transparent to advertisers. A portion of the improved margin is tied to the provisioning of agency-owned services such as in-house studios, trading desks, poster specialists, barter firms and production companies. These services have tremendous margin upside for an agency because there is limited disclosure to the advertiser of the rates paid to the ultimate media seller and or the fees earned by the agency in the form of incremental commissions, spread between planned and purchased costs or volume rebates paid by the media. Then there are sources of agency revenue which are seldom discussed and rarely audited which contribute to an agency’s bottom line profits. These include but are not limited to AVBs, interest income from float, earned but un-processed discounts, rebates and no-charge media weight.

These practices are neither good, nor bad they simply represent the nature, albeit murky, of the global advertising industry today. In the end, knowledge is power. For example, the agencies that have been smart enough to vertically integrate and to leverage non-transparent income “opportunities” have generated solid bottom line performance.

For advertisers the answer is simple, extend your knowledge of what is clearly a dynamic and often opaque marketplace:

- Revisit your agency contracts to make sure that the requisite legal and financial controls have been incorporated to protect your interest.

- Make sure that your agency contract extends to the parent company and any sister divisions which may be engaged as part of your agency’s service offering.

- Examine your agency performance evaluation process and remuneration methodology to ensure that you are incenting the behavior and outcomes which you desire.

- Engage an independent auditor to assess your marketing service agencies contract compliance and performance to make sure that the requisite level of transparency is always maintained.

In the words of Sir Edward Coke, the renowned seventeenth-century English jurist;

“Precaution is better than cure.”

If you’re interested in a second opinion of the soundness of your client/ agency agreement or would like to discuss the benefits of an agency contract compliance audit, contact Cliff Campeau, Principal at AARM via email at ccampeau@aarmusa.com.