It came as no surprise to anyone in the industry when Accenture recently announced the launch of its programmatic ad unit. After all, weeks before Accenture had completed the acquisition of Meredith’s digital media unit MXM. Further, over the course of the last few years many of the large management consultancies, including Accenture, had acquired creative, design, digital, CRM, Social and full-service agencies as they looked to expand their presence in the marketing services sector.

It came as no surprise to anyone in the industry when Accenture recently announced the launch of its programmatic ad unit. After all, weeks before Accenture had completed the acquisition of Meredith’s digital media unit MXM. Further, over the course of the last few years many of the large management consultancies, including Accenture, had acquired creative, design, digital, CRM, Social and full-service agencies as they looked to expand their presence in the marketing services sector.

The row over Accenture’s announcement, at least within the agency community, was focused on its Media Management practice and the work that they do globally in the media auditing and agency review space. The argument proffered by agencies and their associations, specifically the 4As and the UK’s IPA, was that it was inappropriate for Accenture to provide media auditing and search consulting services and programmatic media buying due to the potential for conflict of interest. In short, the agencies expressed concern that Accenture would utilize the data that is accesses in its media management practice to inform its work in the programmatic buying area.

Many would argue that the “conflict of interest” defense raised by the agency community rings hollow. This is due to the fact that Accenture and other management consulting firms routinely implement firewalls and processes to separate and protect data from one client or practice being co-mingled or misused intentionally or not by another.

Further, the agency community has had its share of “conflict of interest” challenges in the recent past ranging from its acceptance of AVBs to media arbitrage to ownership interests in intermediary firms not disclosed to clients that have served to undermine their credibility and the level of trust clients are willing to afford them. Thus, while Accenture’s announcement may be a sensitive topic for agencies, clients will likely have little concern.

Let’s face it, the world is changing and the media landscape has become more complex thanks in large to the growing impact of technology, accelerated levels of media fragmentation and fundamental shifts in consumer media consumption habits. Marketers in particular have become more highly focused on the effective use of data and insights to better target select audiences, geographies, behaviors, etc. Thus, organizations looking to boost their performance and to optimize their marketing investment, are seeking partners that can provide holistic, objective, strategic insights to guide their decision making.

Management Consultants are well positioned to provide the requisite marketplace, competitive and consumer assessments along with strategic recommendations and tactical implementation support across the evolving marketing funnel. Global in scope, the large consultancies have hundreds of thousands of employees, serving in a variety of specialized practices that can be tapped to work with marketers in the identification of problems and opportunities and the pursuit of strategies to achieve their business objectives. The addition of programmatic media capabilities to encompass planning and buying is a logical extension of the consultants service offerings.

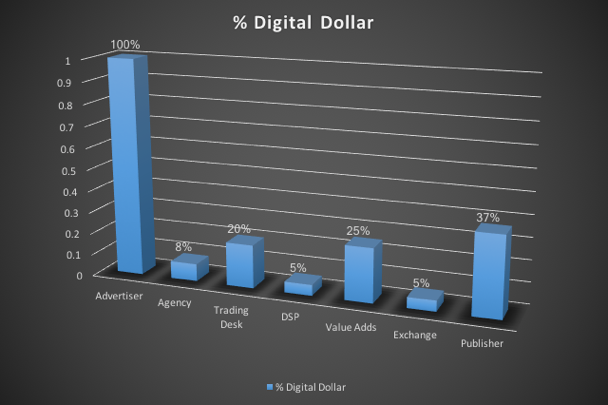

Media agencies were long the profit engines for agency holding companies and the onset of digital media and the meteoric growth of programmatic buying represented a boon for media agency margins. Unfortunately, revelations about certain buying practices and growing advertiser concern over the lack of transparency surrounding their digital media investment ushered in a period in which advertisers began to actively evaluate new media agency partners, tighter client-agency contracts and new digital media models. It should be noted that among the new models that advertisers have pursued has been bringing aspects of the programmatic media buying process in-house, often with the counsel and assistance of management consulting firms. These trends have allowed the consultancies to curry favor with CEOs and CMOs and to expand their toe hold in what had been space traditionally dominated by ad agencies.

Given the size of the global programmatic marketplace, measured at $14.2 billion in 2015 and estimated to be $36.8 billion in 2019 (source: MAGNA Global, June, 2016), it is easy to see the appeal for the management consulting firms in general and Accenture in specific. As an aside, the market potential in this sector dwarfs the size of the media auditing and review market by a wide margin.

The media agency community would best be served by focusing on what it can do to leverage its position of strength to protect its share of the media planning and buying business. Time spent focused on “conflict of interest” claims as a defense against incursions from consultants or other non-traditional competitors will likely garner little support outside of the agency community and will therefore not be productive.